Speaking of boats at or near 50 years in age, the huge surge in sailboat sales happened as a result of the oil embargo and fuel shortages in 1973-74. Seems like there's gotta be an agent that can shop around for a policy for your boat. (and a lot of others, as well.) My experiences are likely not that unusual - finding an agent, providing them with all the info including a survey, and them finding an insurer. Sheesh, this is frustrating.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stunned by insurance increase!

- Thread starter Alan Gomes

- Start date

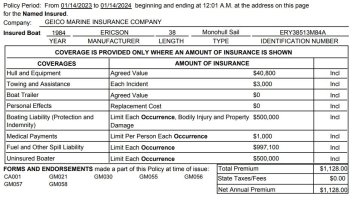

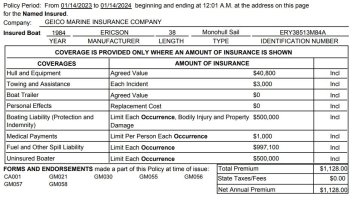

Yes, mine is way up, too. It was $700 a couple of years ago. You may wonder why the insured value is $40K when the boat is worth, around here, nearly twice as much.

Well, there is no insurance at all for singlehanders offshore. And I figure the boat will probably not be a total loss for a typical claim such as running into somebody, hitting a rock, losing the mast, theft of items and so on. The entire calculation is a shrug.

Well, there is no insurance at all for singlehanders offshore. And I figure the boat will probably not be a total loss for a typical claim such as running into somebody, hitting a rock, losing the mast, theft of items and so on. The entire calculation is a shrug.

RedDog

Member II

Thank you! I'm finding that this insurance thing is damping out the fun of owning a Sailboat.Speaking of boats at or near 50 years in age, the huge surge in sailboat sales happened as a result of the oil embargo and fuel shortages in 1973-74. Seems like there's gotta be an agent that can shop around for a policy for your boat. (and a lot of others, as well.) My experiences are likely not that unusual - finding an agent, providing them with all the info including a survey, and them finding an insurer. Sheesh, this is frustrating.

We just want that contented dog to continue to sail !

RedDog

Member II

Yes!! His name is Red. He is 12 years old and a bit blind but he gets really comfortable aboard Coqui.We just want that contented dog to continue to sail !

@RedDog have you talked with AMG Insurance in Florida? We use them even though we’re in across the country in Seattle. We compared them against two PNW brokers and they were very helpful and found us a policy that works for us (although fingers crossed things don’t change when we renew this fall as this thread is making me nervous). Kerry Gonzalez was who we worked with. 561-293-0900.

Kif

Junior Member

Bgary - we also seem to be losing Geico coverage - would love to know the details on NovaMar. I'm part of a boat share, and we've been quoted 1400 for a 1973 Ericson 32 from progressive, which seems crazy given what I'm seeing here.That's better (or maybe not) than mine. I had GEICO and was informed that they had decided to exit the recreational-marine market, and that my policy was being canceled at the end of the term. So I had about 2 months to find something new. Insurance broker (NovaMar, highly recommend) got me a policy with Progressive. Better coverage, better cruising range, and less money.

B

Perhaps the "boat share" title affects your quote. Note that the insurance company is calculating risk based on number of operators as well as the value of the asset. I hasten to add that this is only my surmise, and I do not have insurance experience.Bgary - we also seem to be losing Geico coverage - would love to know the details on NovaMar. I'm part of a boat share, and we've been quoted 1400 for a 1973 Ericson 32 from progressive, which seems crazy given what I'm seeing here.

Do not doubt the value of a current survey when shopping insurance, either. Establishing the true "value" of the asset is a key component.

We are insured for approx 170K Agree Value, and pay a little over $1500. in annual premium.

(figures edited for accuracy.)

In my naive view, for $1400. you might be insuring about $140000. in Agreed Value.

Perhaps appropriate for a fully restored-to-new boat, if yours is.

From up here in Portland, I am probably just too far away from your insurance market. Have you contacted an" insurance broker"? We go thru Boat Insurance Agency, in Seattle.

I wonder if the California insurance market is radically Different from ours in Oregon?

Last edited:

Kif

Junior Member

Yes that might be it (boat share), but this boat is probably worth 16k. Definitely not 140k.Perhaps the "boat share" title affects your quote. Note that the insurance company is calculating risk based on number of operators as well as the value of the asset. I hasten to add that this is only my surmise, and I do not have insurance experience.

Do not doubt the value of a current survey when shopping insurance, either. Establishing the true "value" of the asset is a key component.

We are insured for approx 170K Agree Value, and pay about ten percent in annual premium.

In my naive view, for $1400. you should be insuring about $140000. in Agreed Value.

Perhaps appropriate for a fully restored-to-new boat, if yours is.

From up here in Portland, I am probably just too darned far away from your insurance market. Have you contacted an insurance broker?

I wonder if the California insurance market is radically Different from ours in Oregon?

One of the other partners has been doing the searching, and with quotes coming back as they are I thought I'd do a little digging on the forum.

If anyone has good broker reccs I'll check them out (I saw NovaMar mentioned above, and already submitted a request).

Pete the Cat

Member III

Geico lost big in the storms in Florida and I think the insurers are seeing the long range of named storms as the result of climate change is a loser. I have a policy with Geico and tried to add my second boat and they would not accept it even though my surveyor spent an hour on the phone with the underwriters about its being in good condition. They are clearly exiting the business, but trying to milk those of us who are left. Folks might consider just buying liabiiity insurance which is very cheap--and will satisfy most marina requirements if you can rationalize the potential loss vs insurance cost.

p.gazibara

Member III

Wow, so we aren’t the only ones struggling. We only carry insurance when we aim to find ourselves in a marina, or when required by the cruising grounds (MX insurance is required when cruising MX.)

Cinderella has been floating happily on a swing mooring up the well protected Waitiamata river in Auckland. Recently Aucklanders have been struggling as the mortgages here are not fixed and last year they jumped by nearly 10%. That stress is shared all down the chain and we as renters were kicked out of our flat a couple months ago. Landlord wanted to Airbnb because it makes her more money.

We have found ourselves moving back aboard for the short term as we look to relocate to the South Island. Being winter we found a marina berth for the month so guess what is again required… insurance.

I phoned 10 different insurers here, none of which wanted to offer coverage to us, not even 3rd party coverage. Either the boat is too old (beyond 30 years) or it’s flagged US (they won’t insure US boats here) or we need a survey to get insurance. Never-mind that we have never made a claim. Meanwhile I watched the insured boats ride out the 2+m swell on their unprotected moorings during the cyclones.

Bit of a pickle if you need to haul to get a survey.

We were finally offered 3rd party only cover for a one month period. Hopefully we can find a surveyor and haul in the next month. I don’t miss the insurance racket.

-p

Cinderella has been floating happily on a swing mooring up the well protected Waitiamata river in Auckland. Recently Aucklanders have been struggling as the mortgages here are not fixed and last year they jumped by nearly 10%. That stress is shared all down the chain and we as renters were kicked out of our flat a couple months ago. Landlord wanted to Airbnb because it makes her more money.

We have found ourselves moving back aboard for the short term as we look to relocate to the South Island. Being winter we found a marina berth for the month so guess what is again required… insurance.

I phoned 10 different insurers here, none of which wanted to offer coverage to us, not even 3rd party coverage. Either the boat is too old (beyond 30 years) or it’s flagged US (they won’t insure US boats here) or we need a survey to get insurance. Never-mind that we have never made a claim. Meanwhile I watched the insured boats ride out the 2+m swell on their unprotected moorings during the cyclones.

Bit of a pickle if you need to haul to get a survey.

We were finally offered 3rd party only cover for a one month period. Hopefully we can find a surveyor and haul in the next month. I don’t miss the insurance racket.

-p

Prairie Schooner

Jeff & Donna, E35-3 purchased 7/21

We were at the 2023 Newport (RI) Boat Show last week and there were quite a few insurance brokers. We’re thinking about switching. Following is a list of a number of them. Most I asked if they covered old boats like ours and they said yes. A couple I just grabbed a coozie or card from their table. Some I specifically asked if they took clients from other parts of the country and they said yes. Others I don’t know. We’ve asked a few for further contact, but I have absolutely no sense about any of them. This list is in No way a recommendation and I/we don’t have any financial connection to them. But it seems like several folks have had trouble finding insurance so I thought this might help. In no particular order:

Fairfield County Bank Insurance Services

Sean O’Leary

sean.oleary@fcbins.com

(203) 894-3117

255 Tunxis Hill Rd. Fairfield, CT

Hefring Marine

Philip Miller

philip@hefringmarine.com

(401) 787-8347

J. J. Best Insurance

Debbie McBride

deborah@jjbest.com

(800) 872-1965 x401

60 N. Water St. New Bedford, MA

Carey, Richmond & Viking

Elizabeth Durgin

edurgin@crvinsurance.com

(401) 314-4672

2 Corporate Place Middletown, RI

Global Marine Insurance Agency

Div. of Specialty Program Group, LLc

globalmarineinsurance.com

(800) 748-0224

Very common requests, in addition to basic boat and personal info, were a recent survey and receipts/documentation for upgrades. As we’ve been talking with our current insurance company, Progressive, they said they would only accept cost of parts toward increased value. Labor would not count.

For what it’s worth. Caveat emptor. Good luck.

Jeff

Fairfield County Bank Insurance Services

Sean O’Leary

sean.oleary@fcbins.com

(203) 894-3117

255 Tunxis Hill Rd. Fairfield, CT

Hefring Marine

Philip Miller

philip@hefringmarine.com

(401) 787-8347

J. J. Best Insurance

Debbie McBride

deborah@jjbest.com

(800) 872-1965 x401

60 N. Water St. New Bedford, MA

Carey, Richmond & Viking

Elizabeth Durgin

edurgin@crvinsurance.com

(401) 314-4672

2 Corporate Place Middletown, RI

Global Marine Insurance Agency

Div. of Specialty Program Group, LLc

globalmarineinsurance.com

(800) 748-0224

Very common requests, in addition to basic boat and personal info, were a recent survey and receipts/documentation for upgrades. As we’ve been talking with our current insurance company, Progressive, they said they would only accept cost of parts toward increased value. Labor would not count.

For what it’s worth. Caveat emptor. Good luck.

Jeff

HerbertFriedman

Member III

My BOATUS insurance from Geico increased from about $510 to $630 or 24% with a 10% decrease in the boat's value. I went to my home/auto insurance company and they quoted me about $600 so I stayed with Geico. Geico acknowledged that I had no claims but that the increase was CA wide.

Bepi

E27 Roxanne

Insurance is necessary for large, expensive things. But when it infiltrates to the point where

activities we used to do, we can no longer do, because of the cost of liabilty insurance, that is a problem. We used to have soap box races, but that's gone because of liability. In my hometown, our boat parade featured a swimming club who for decades would push a 3 part dragon,

and the city had to tell this club that they could no longer participate. Why? liability. Insurance is sterilizing our culture And making us pathologically risk averse and the cost, at all levels, keeps rising. Will we hit a point where insurance is so expensive

that average people will not be able to sail? .02 +/-

activities we used to do, we can no longer do, because of the cost of liabilty insurance, that is a problem. We used to have soap box races, but that's gone because of liability. In my hometown, our boat parade featured a swimming club who for decades would push a 3 part dragon,

and the city had to tell this club that they could no longer participate. Why? liability. Insurance is sterilizing our culture And making us pathologically risk averse and the cost, at all levels, keeps rising. Will we hit a point where insurance is so expensive

that average people will not be able to sail? .02 +/-

That's terrible.I just got my renewal from Geico, increased from 1K to 1.6K, agreed value reduced from 30k to 27K. No claims record. Boat Us/Geico. Unacceptable but others are worst!

I have to wonder if you have two insurance difficulties, insuring with Geico and owning a boat in hurricane-prone Florida? Have you checked with an independent agent as I did? (Your premium is higher than ours, for a boat valued at a fraction of our boat's agreed value.)

Hcard

Member III

Hi Loren, checked with Progressive and the quote was worst. Finding coverage in Fla is a challenge for everything the wind might pick up. If you have a marine agent i would appreciate the contact, they might have carriers that would insure here. I am thinking of dropping the hull insurance and keeping the Liab at 300k, (required by the marina)That's terrible.

I have to wonder if you have two insurance difficulties, insuring with Geico and owning a boat in hurricane-prone Florida? Have you checked with an independent agent as I did? (Your premium is higher than ours, for a boat valued at a fraction of our boat's agreed value.)

A link is in reply #49.

Good luck!

Good luck!

K2MSmith

Sustaining Member

I have State Farm in CA and so far so good; I haven't see any drastic changes. The insurance business in CA is under a lot of stress. I am hearing about a lot of home policies being cancelled and insurance companies just getting out of that business.I just received a text today remining me that my autopayment for my Geico/BoatUS insurance was going to take place on August 13. I was shocked when I noticed that the amount had increased by 50% from last year! (Last year I paid $380 and my upcoming payment will be $579.)

When I called, I was told that it had nothing to do with my specific policy, since I have not filed any claims in the last year or had any other issues related to my particular boat. Rather, I was told that it was tied to more "regional" changes, i.e., in California, due to increasing repair costs, the number of claims they are receiving for a particular area, etc. The answer was very general so I was not told more than this, but it appeared to be primarily a California thing.

I called back so I could talk to another representative just to see if I got the same story. It was basically the same, though the second one said that there have been price increases across the country, so now I'm not sure how much of this is tied specifically to being in California.

I'd be curious as to what the rest of you are seeing on your policies as they are coming up for renewal.