Joe,

I have no issue with someone owning, registering, keeping a boat in RI for tax reasons, many do and if its legal, more power to them. I know it creates lots of jobs for Rhode Islanders. There are lots of large, very expensive boats with out-of-state owners here. What made me feel sorta sick is the fact that John Kerry, a man with more money than I could ever spend, chose to have a custom boat built in New Zealand. If he was just any rich dude, well fine, thats his prerogative. But hes not, hes an elected official. There are plenty of world class boat builders in Mass and even the rest of New England that could build him anything he wanted, and he chose to buy elsewhere. To me that speaks volumes of his real feelings towards the common working man and local industry. At least hes not in my state.... RT

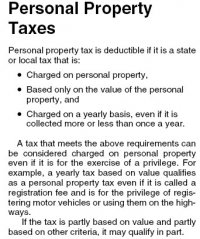

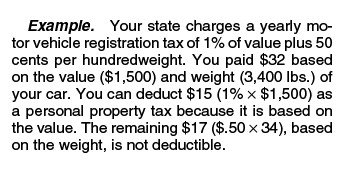

Has anybody tried to use this as an itemized

Has anybody tried to use this as an itemized